How OCR Technology Is Advancing Fintech

- Funder Intel Admin

- May 11, 2023

- 2 min read

The financial technology industry, or Fintech, as it's affectionately known, has been experiencing a seismic shift.

The cause?

Optical Character Recognition (OCR) technology.

Yes, this mouthful of a term is making waves in the fintech ocean, and, trust me, you'll want to ride this surf.

Let's start at the beginning.

So, what's OCR technology, and why is it creating such a buzz? OCR is a technological tour de force that allows you to convert different types of documents—scanned paper documents, PDF files, or even images captured by a digital camera—into editable and searchable data. Imagine you are looking at a picture of a document, but your computer sees it as text it can understand and manipulate. Impressive, right?

It's more than just impressive; it's a game-changer for lenders. If you're wondering why lenders are jumping on the OCR bandwagon, the answer is simple: Efficiency and accuracy. OCR technology has the potential to take a lender's game from zero to hero, transforming how they process and evaluate loan applications.

In the past, when a business applied for a loan, the lender had to painstakingly enter the data manually from physical documents into their system. It was a slow, error-prone process.

Cue OCR technology.

Now, lenders can simply scan the documents, and OCR technology does the rest. Data is extracted, analyzed, and stored with a level of accuracy that far surpasses any human data entry clerk.

But here's the real kicker. Not only does OCR technology streamline the lending process, it also enables greater accessibility to financial services. Smaller businesses, previously overlooked due to the complexity of manual processing, are now getting their fair share of the pie. OCR has effectively democratized business lending, giving every business, big or small, a shot at its dreams.

The broader fintech industry.

The arrival of OCR technology has been nothing short of a revolution. The real estate of financial services is no longer confined to the four walls of a bank. OCR technology has made remote and digital banking not just a possibility, but a reality. From digital wallets to e-check deposits, OCR technology is facilitating a more user-friendly, efficient, and accessible financial ecosystem.

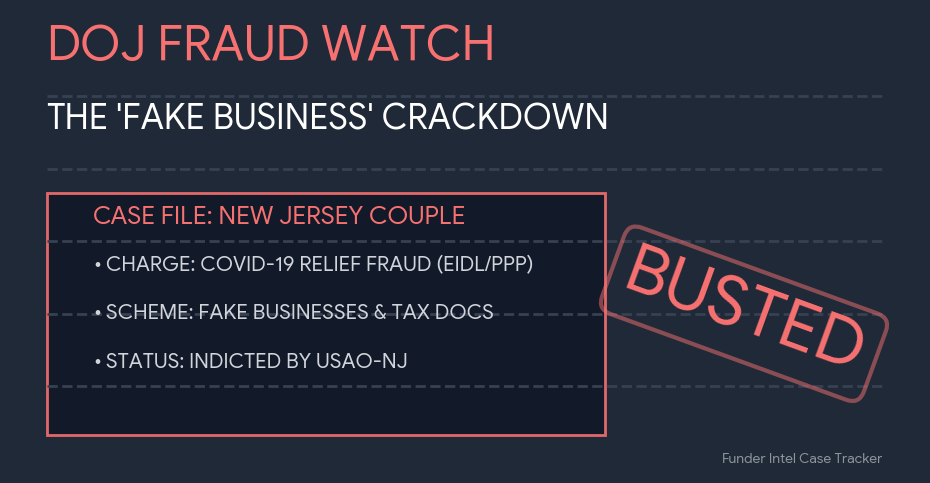

Moreover, OCR is instrumental in combating fraud. By identifying counterfeit documents and inconsistencies, it plays a key role in maintaining the integrity of the financial sector. So, while it's speeding up processes, it's also ensuring the safety of financial interactions.

To sum it up, OCR technology is the unsung hero of the fintech revolution. It's changing the face of business lending and redefining the broader financial landscape. It's making services more efficient, accurate, and accessible. In the world of finance, where time and precision equate to money, this is no small feat.

The OCR wave is here, and it's set to shape the future of fintech. And as it continues to evolve, who knows what other exciting transformations it will bring? So, buckle up, because this is one financial roller coaster ride you don't want to miss.

Comments